Current Temperature

11.4°C

Historically, Canada knows the impacts of uncontrollable debt

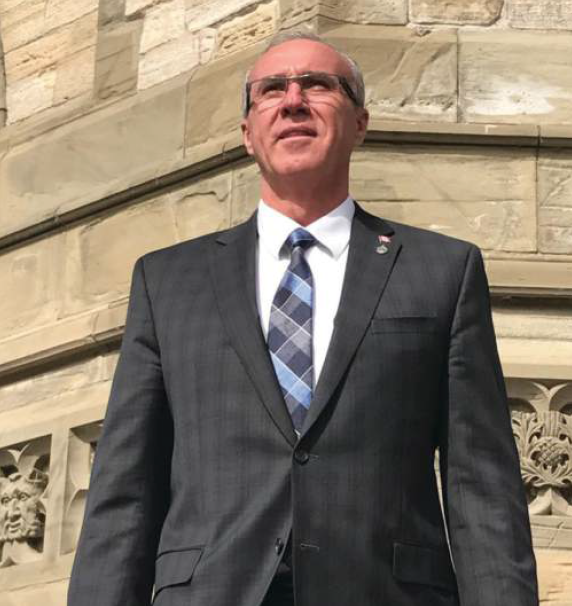

Posted on May 13, 2021 by admin Glen Motz

Glen MotzBy Glen Motz

Medicine Hat-Cardston-Warner MP

First impression of the federal budget is there is money for everyone and nearly every conceivable cause. However, closer reflection reveals the $100s of billions price tag for these federal government promises expected over the next three years is not only partisan selfishness, it is irrational to burden future generations with massive debt.

We needed and expected a budget that addressed today’s critical challenge — getting the COVID-19 pandemic under control and the desperate need for a clear plan towards a sense of normalcy. Instead, we got a Liberal election platform filled with unsustainable programs that will send federal net debt levels to $1.4 trillion by 2026. The budget ignored the critical needs facing health care across the country, while anything directed towards small businesses and workers is just a continuation of the current COVID-19 temporary support programs. Disturbingly absent is a dynamic post-pandemic economic growth plan.

In post-budget media interviews Trudeau and his finance minister repeatedly stressed with interest rates currently so low now is the time to borrow and spend. They came across like used-car salespersons and not leaders of a nation in crisis, with thousands unemployed, daily business foreclosures and a population worried for its future. The debt associated with this budget — on top of Canada’s current load — will be crushing for taxpayers.

However, a big segment of taxpayers will remember in the 1970s another Trudeau prime minister ran up massive debt to accommodate larger federal government, expanded social programs and spending. That Liberal did this by printing more money, getting loans from international markets and running deficits. The result of that borrowing and higher debt costs was inflation — the dollar bought less and everything cost more. At its peak, Canada saw 18 per cent interest rates. So, consider if your current 2 per cent debt repayment jumped by 16 per cent tomorrow, would you be financially stable? History knows it can happen.

Today’s question isn’t if interest and inflation will hit Canada, but rather when and by how much. The fear — when inflation begins to rise rapidly — incomes will not rise as quickly and many families will not be able to afford everything they need. Meanwhile, the federal government’s costs will increase because everything is more expensive, and its $40 billion annual debt servicing costs will increase. There will be little room for future government to help Canadians. This is what happened in the 1970s — right around the time the elder Trudeau rode off into the sunset.

Trudeau 2.0 has the same vision as his father, adding debt in an effort to create a personal legacy, all at the expense of our country. Conservatives know the process to build a stable economy takes time. It will take patience to get this right, but Trudeau is too impatient to do what’s right.

Leave a Reply

You must be logged in to post a comment.